Millions of traders with different trading styles and needs choose MetaTrader 4 to navigate the financial markets. From advanced technical analysis to algorithmic trading, the platform offers among the broadest forex trading opportunities.

Amidst the range of solutions MT4 offers, are three types of trade execution modes, two market orders, four pending orders, two stop orders and one trailing stop, giving a trader a high degree of flexibility across different financial instruments and market conditions. By placing an order, a trader essentially gives their broker instructions to enter or exit a position on their behalf. These are critical tools to properly execute a trading strategy, protect profits and limit risks.

The range of order types might be overwhelming for a beginner, which is why we’re taking a look at them here, as well as the best situations to apply them.

Entering a New Order on MT4

On the MT4 platform, traders simply need to click on “New Order” on the top toolbar, after which the order window opens. Here, you need to fill in important details, such as “Symbol,” “Lots” and “Type” of the order. It is in this “Type” category that you can choose to enter into various order types.

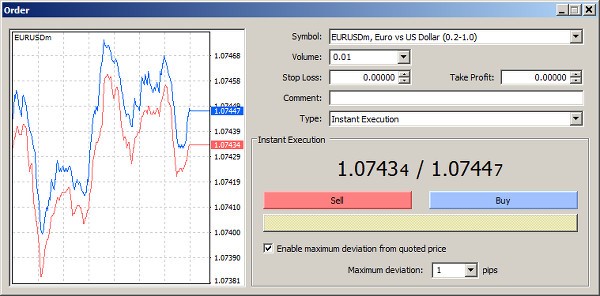

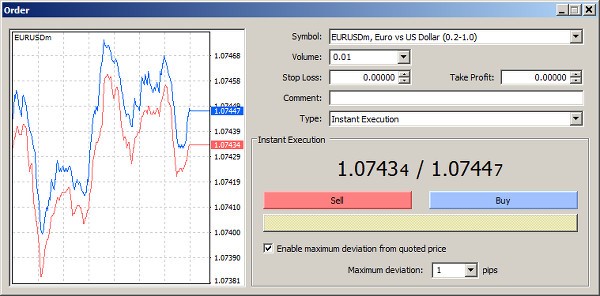

New orders can also be launched simply through a right-click on any currency chart, and then clicking on “New Order.” You can also click on the desired symbol in the “Marketwatch” window, and then click on “New Order.” Below is a representation of the order window, which will pop up in each case.

You will find that the order window comes populated, for you to instantly enter into a trade at the current market price. This means the order type will be set on “Instant Execution.” According to the illustration above, an instant execution “Buy Order” will be implemented at a price of 1.0744 (the offer price in the above image) and a “Sell Order” will be go through at 1.0743 (the bid price in the image).

Choosing Between Instant and Market Execution

In instant execution, the broker will attempt to execute the order with the latest price you are able to see on the platform. There is a chance that the price changes while your order is being processed. If this change is greater than the “Maximum Deviation” parametre, the broker will offer a requote, which you can accept or decline. The basic advantage of this mode is that traders are able to enter a trade at a known or desired price. However, during high volatility periods, good trading opportunities might get missed.

Most ECN brokers offer market execution, which means that orders are executed at real-time price, irrespective of what you see on the platform. This results in surer and faster execution and no requotes. But then, the risk of slippage during high volatility periods is possible here too.

Using a Pending Order

When traders want to enter markets quickly at the current price, market orders (instant execution) are the way to go. Currencies will be bought at the ask price and sold at the bid price. You can also enter stop loss levels and take-profit parametres with these orders, to minimise risk.

However, when traders want prices to fulfill certain criteria first, pending orders are more useful. With the selection of “Pending order,” four new order types become available to choose from:

- Buy Limit: This allows you to buy a currency, provided the future ask price meets a predefined price level. This type of order is usually chosen when an asset has been on a decline for some time, and expectations are that the price will rise in the near future.

- Buy Stop: This is when the asset has reached a certain level and will likely continue to experience a price increase. The current price level here is lower than the order price.

- Sell Limit: This allows you to sell a currency pair, provided the future bid price is equal to a pre-defined value. This is when a currency price is expected to drop, after reaching peak levels.

- Sell Stop: This order is usually placed in anticipation of currency prices continuing to decline, after having reached a certain level. Here, the current price level is higher than that specified in the order.

Limit orders can be used to enter into trades when traders are able to identify good support and resistance levels. Stop orders, on the other hand, could be viable to enter into breakout trades.

The main advantage of using a pending order is that one can employ it in advance, to enter or exit a position, in the event of a particular price action. For instance, if you want to place an order upon completion of a specific price pattern, you can do so through a pending order. There are trading strategies that include opening trades when prices breakout or bounce at a price range boundary.

Depending on your strategy, you can place an order to take advantage of the market move. Traders get to be selective about entering trades. Rather than random trade entries, it is useful to have a tried and tested plan.

Stop loss and take profit orders can be attached to pending orders. These levels will be attached to the open pending order positions automatically, once they have been launched.

Stop Loss and Take Profit

Stop loss is used to minimise losses, if prices start moving in an unfavourable direction. Orders get stopped automatically, if the price levels reach a pre-defined point. They can only be placed along with a market or pending order. You can also use “Trailing Stop” to automate stop-loss orders to a break-even level. However, trailing stops is processed once per tick.

Take profit is used to protect any already accumulated profits, once the price reaches a certain level. The execution of this order type leads to closing of the position. Both stop-loss and take-profit are critical risk management tools that traders use, regardless of their trading strategy.

Reference Links