Before making online purchases, whether it’s a hotel booking or new phone, most people will do their research and inevitably end up on review sites. So why wouldn’t you put the same time and energy into looking at trading software reviews? After all, the trading software you use is an integral part of your forex trading and ultimate success. The market is flooded with brokers offering online trading services, using a vast variety of trading software, equipped with advanced algorithms that help forex traders carry out their trades smoothly.

A huge advantage of these trading platforms, and the software embedded in them, is the inclusion of advanced technical analysis tools and several other tools that can help traders make quick decisions and implement them efficiently. The advantages of using trading software cannot be ignored but certain things need to be kept in mind when choosing one for forex trading.

Studying various trading software reviews by experts as well as actual user reviews provides new traders a chance to choose the best options available, without needing to resort to trial and error.

Choosing the Right Trading Software

Choosing the right trading software is as important as developing a trading strategy or choosing a good broker. Since it is difficult for a trader to check out all the features of the various trading platform packages offered online, reviews play an important role. The various types of trading platforms available in the market today include:

- Those that allow manual management and execution of forex trades.

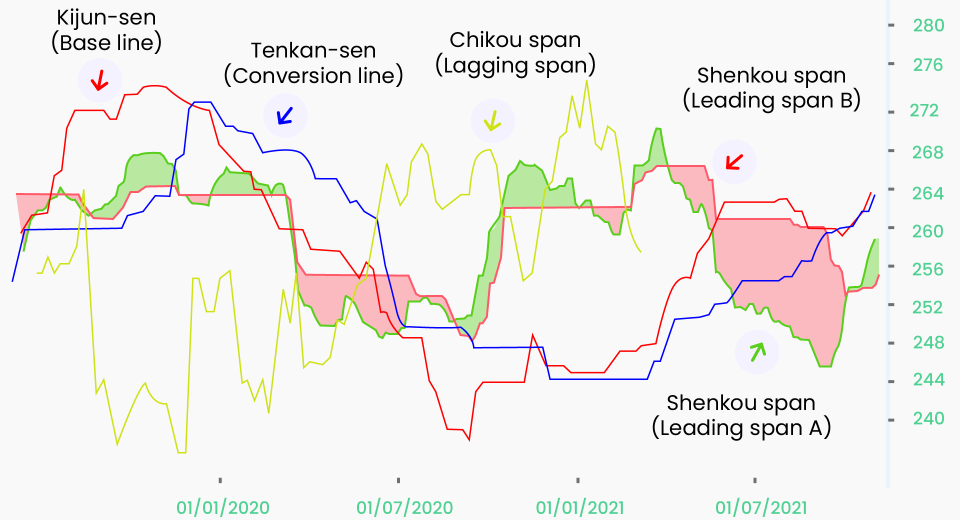

- Those with software that incorporates technical analysis charts and indicators.

- Those with software that includes technical signal generators that provide recommendations about levels at which a trader can initiate or close positions.

- Those that offer automated systems or forex robots that execute trades automatically, based on a pre-programmed trading algorithm.

Traders can download the chosen trading software, try them out to learn about their efficiency and usefulness and choose the most suitable. But this is a cumbersome process. A better option would be to read product reviews and choose the one rated the best by a maximum number of user or experts. Advanced software not only helps traders place their trades but can also manage multiple trading accounts, while offering charting functionalities and algorithmic trading support.

Features to Check in Trading Software

Features that should you look for when choosing trading software include:

- The software should provide the account and portfolio information of each account holder. Information related to account balance, history reports and statements are a must for developing future trading strategies. This information is also useful for tax planning and future order planning.

- It should offer the facility to trade in all major currency pairs and cross currency pairs.

- The software should allow you to set up personalised alerts, automated triggers, place conditional orders and use in-built charting tools.

- Customer service and support provided by the trading platform operator is important too. Services like live chat, email and phone responses are important for online forex trading, since the markets work around the clock.

- Mobile Trading is the latest facility offered by several trading platforms. This facility allows forex traders to access their accounts via their mobile devices even on the go.

- The purchase and refund policy of the trading software provider is important and should be checked before purchase. Always opt for software that has a trial period and allows you to return the product within a pre-specified period in case you are dissatisfied.

- Opt for software that comes with regular free updates or choose online or web based trading platforms that can be used via a username and password. These platforms can be used from anywhere, as long as you have an internet connection.

- Ensure that the software and the broker use appropriate data security measures to protect your data.

- User manuals and instructional videos help in easy installation and smooth usage of trading software. They also help in troubleshooting, besides providing contact information in case additional support is required.

- Good trading platforms provide access to high quality news feeds from reliable sources, which prove very useful in making trade decisions, especially those that are based on fundamental analysis.

When you go through user reviews, look for all these characteristics, while also checking for insights into the pros and cons of the trading software, before making a final purchasing decision.

Disclaimer

If you liked this educational article please consult our Risk Disclosure Notice before starting to trade. Trading leveraged products involves a high level of risk. You may lose more than your invested capital.